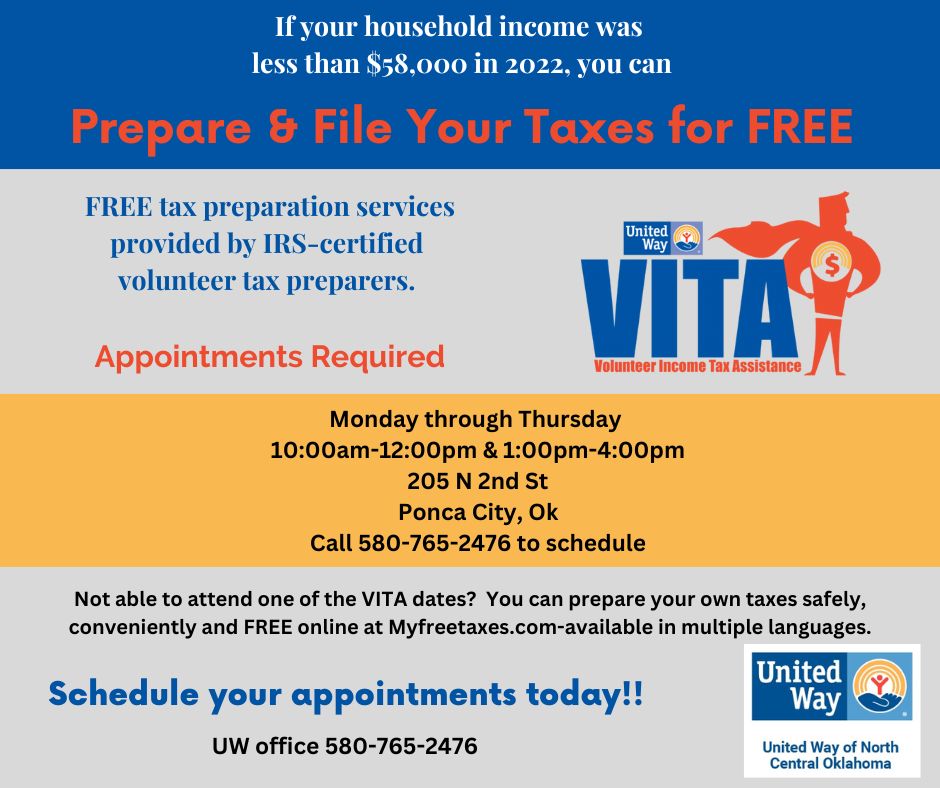

United Way’s Volunteer Income Tax Assistance (VITA) program offers free tax preparation for families and individuals with income of $58,000 or less.

This program promotes financial well-being. Our team of staff and volunteers prepare income tax returns for qualifying families and individuals and advocate for the Earned Income Tax Credit (EITC). Our work ensures that tax returns are accurate and everyone receives their full refund and avoids unclaimed tax credits, fees for tax preparation services and refund anticipation loans.